🔑 Key Takeaways

Web3, blockchain, and tokenisation mark the next major phase of digital transformation, reshaping how businesses create, exchange, and protect value.

These technologies offer powerful potential, but practical adoption depends on regulatory clarity, technical maturity, and real-world relevance of use cases.

The UK’s cautious approach, while deliberate, risks placing it behind the US and EU unless it accelerates implementation and offers clear support for innovation.

Public perception and government rhetoric have not yet translated into broad understanding or tangible policy action, especially post-Brexit.

Business leaders — particularly in SMEs — must start building literacy in these technologies now to remain competitive and influence the shape of the coming decade.

(You can also read this article on LinkedIn)

The past thirty years have been characterised by digital transformation as the focal point of strategic evolution in business. From the early adoption of internet connectivity (web1) to the dynamic, user-driven platforms of the social media age (web2), businesses have navigated rapid shifts in technology and customer interaction.

The focus for many executives has been on integrating digital tools to improve efficiency, enhance customer engagement, and streamline operations. Web1 brought basic connectivity, enabling companies to establish a digital presence. Web2 introduced interaction and data-driven decision-making, giving rise to digital marketplaces, social media, and personalised experiences. These changes were, and still are, fundamental to business success.

However, as we stand on the brink of a new era, it is becoming increasingly clear that the next decade will be shaped by a different wave of digital transformation. Web3, blockchain and tokenisation are emerging as the technological developments which will define the next chapter for businesses, blending with other digital innovations like the Internet of Things (IoT) to create interconnected ecosystems of value and trust.

The Emerging Sectors of Web3, Blockchain, and Tokenisation

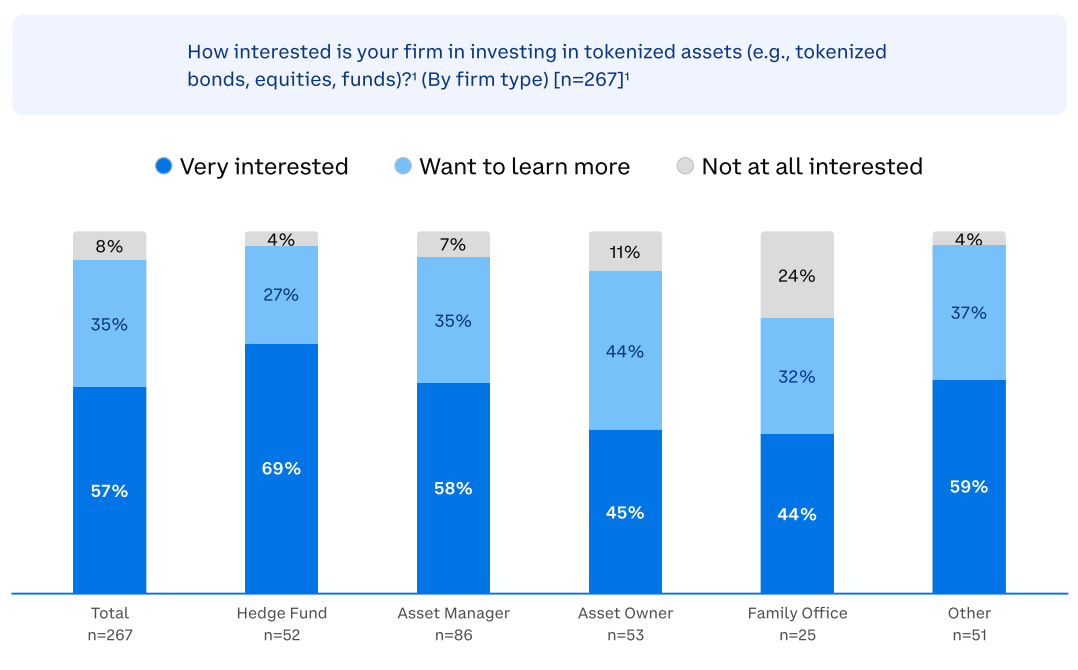

For many executives, the concepts of Web3, blockchain, and RWA tokenisation can feel abstract or futuristic. Yet, their development is not just hypothetical; it is already happening, and businesses that fail to engage with these concepts risk being left behind.

Web3 represents the next iteration of the internet, moving away from centralised platforms controlled by a few dominant players to a more decentralised architecture. It is characterised by ownership, interoperability and user control, fundamentally changing how data is managed and shared.

Blockchain technology underpins this evolution, offering a decentralised and immutable ledger that records transactions transparently and securely. Initially associated with cryptocurrencies such as Bitcoin, blockchain is now being recognised for its potential to transform industries such as finance, supply chain management, and real estate.

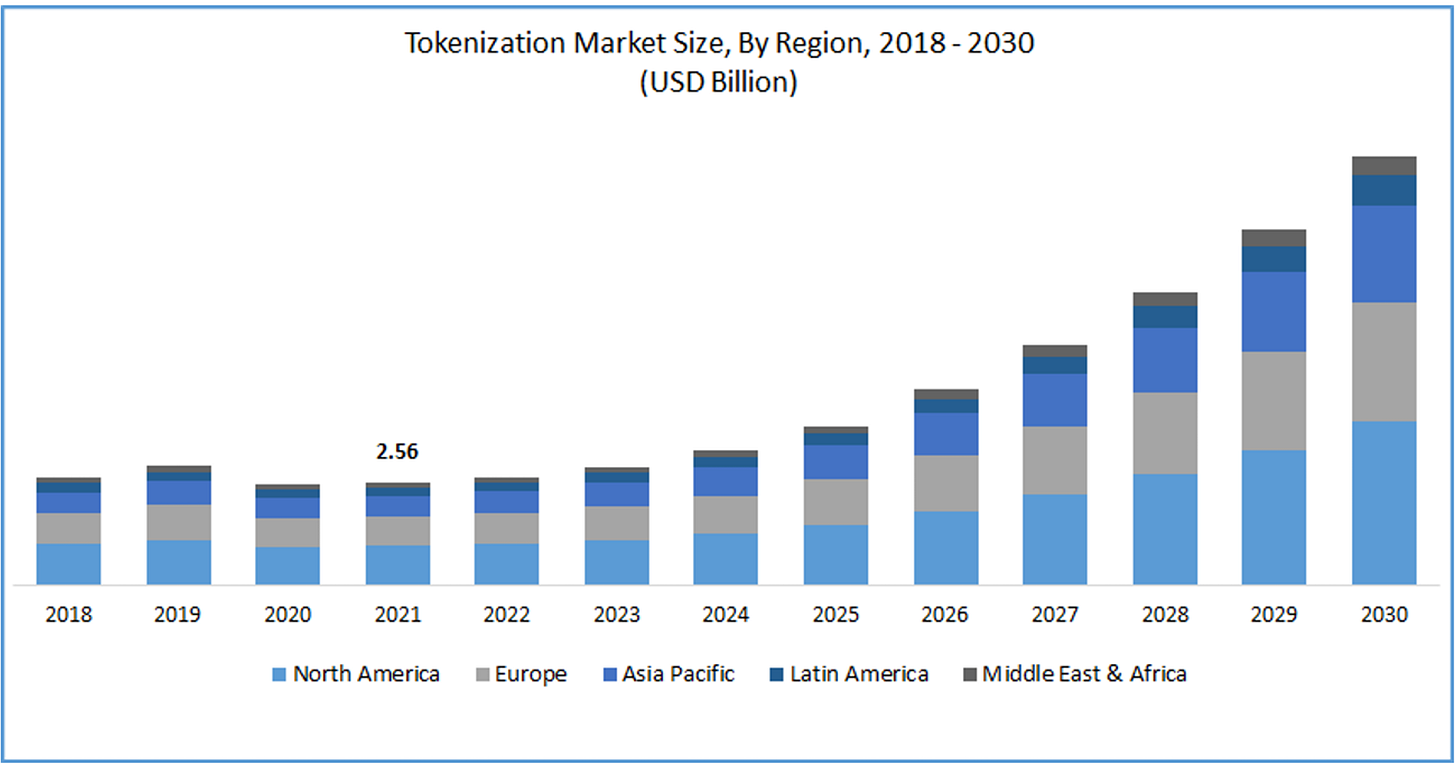

RWA Tokenisation is an extension of blockchain technology and smart contracts, enabling physical or traditional financial assets to be digitised and represented on the blockchain. This development has significant implications for sectors reliant on asset management, ownership tracking, and liquidity management.

As I have been immersing myself in these fields, I find that the challenge is not just understanding the technical aspects but assessing their practical application. As with any past technological disruption, some use cases will prove more relevant and enduring than others. Not every idea will withstand scrutiny, and some projects will inevitably fade as reality tests their viability.

The Things to Come – A New Business and Financial Order

The potential of these technologies goes beyond innovation for its own sake. If adopted strategically, Web3, blockchain and tokenisation could create entirely new business models and financial frameworks. Imagine interconnected supply chains where every transaction is validated on a transparent ledger, reducing fraud and increasing efficiency. Imagine tokenised real estate markets where fractional ownership of assets, income streams, ultra-low transaction costs and instant liquidity become norms rather than exceptions.

In addition, the convergence of blockchain, IoT and Artificial Intelligence – especially in the form of AI agents – could enable autonomous, self-executing contracts between smart devices, where transactions are initiated and validated without human intervention. This could transform logistics, energy management, and even healthcare by linking physical assets with digital verification.

However, the reality is that much of this is still conceptual. While some businesses are making bold moves, others are cautiously exploring the potential while waiting for regulatory clarity and proven use cases.

The UK's Adoption Journey – Progress and Pitfalls

In the UK, businesses and financial institutions have shown interest but remain largely cautious. Pilot projects are ongoing, but widespread adoption has been slow. The Financial Conduct Authority (FCA) has taken steps to encourage innovation, such as regulatory sandboxes, but has also maintained a rigorous stance on consumer protection; a balance that has received both praise and criticism.

In contrast, the US, particularly under the current administration, has shown a more proactive stance, actively encouraging blockchain integration and promoting a crypto-friendly environment. Although the outcome of this US stance remains to be seen in light of the current turmoil, this political support, coupled with the entrepreneurial culture, means that adoption by large financial institutions is happening at a frightening pace. Should we stand still and observe on this side of the pond, or ensure that we keep up with what may well be a ‘new world order’?

Technological Infrastructure and Market Adoption – UK vs US

The UK has a robust digital infrastructure, but its blockchain-specific ecosystem is fragmented and cautious. While the London Stock Exchange has experimented with blockchain for trading and settlement, widespread commercial application remains limited. There is an argument that in the EU, the EU's Markets in Crypto-Assets (MiCA) regulation could to provide greater legal certainty, potentially giving EU-based projects a clearer framework to grow.

Meanwhile in the US, established tech giants and fintech disruptors alike have been more aggressive in developing blockchain applications, benefiting from a culture that is inherently more risk-tolerant. This willingness to experiment and fail fast is a stark contrast to the UK’s more cautious approach, where regulatory ambiguity often leads to hesitancy.

Some policy experts have suggested that the UK’s adoption of a more measured and phased approach to digital regulation may be deliberate, potentially giving the UK a "second-mover advantage". This strategy could allow the UK to learn from MiCA's implementation and refine its own regulatory framework accordingly.

However, in my view, this perspective could work (as highlighted by the Crypto Council for Innovation) only if the UK can mobilise and accelerate the pace of implementation. Otherwise, MiCA itself could be seen as a 'second-mover' approach. The European Commission and its advisory bodies, which have contributed to drafting MiCA, have drawn extensively, and attempted to capitalise, on the US’ fragmented and (until recently) enforcement-driven approach. Therefore, it may well be the case that the UK ends up as the 'third mover', rather than gaining a strategic advantage.

Public Perception and Government Support. More Talk Than Action?

Public awareness of blockchain and tokenisation remains limited, with many associating these technologies primarily with speculative cryptocurrency investments.

This perception problem is compounded by political rhetoric that often lacks actionable policy. While the UK government has expressed interest in becoming a hub for blockchain innovation, concrete, large-scale support remains sparse.

There is growing evidence that the slow pace of digital asset legislation and adoption in the UK has made crypto companies increasingly hesitant to invest in the country. In a post-Brexit environment, the UK’s ability to collaborate on European digital initiatives has been significantly limited. Although efforts have been made to harmonise regulation with global standards, the loss of EU-wide frameworks has created a gap that UK businesses are still struggling to navigate.

What Does This Mean for UK Businesses, Especially SMEs?

For many UK businesses, particularly SMEs, digital transformation remains rooted in traditional approaches; web2 solutions that improve customer interaction or operational efficiency. The strategic challenge now is not to abandon these practices, but to start exploring how blockchain, Web3 and tokenisation might enhance existing models, create entirely new revenue streams and further strengthen cyber security.

Executives need to build literacy in these technologies to make informed decisions, rather than simply waiting for the landscape to stabilise. Waiting for certainty could mean missing opportunities to lead, rather than follow (or fall behind).

Positioning for the Future and The Role of Business Leaders

To remain relevant, UK businesses must engage proactively with the evolving digital landscape. Executives should start by educating themselves and their teams on the core concepts of blockchain and Web3.

Industries likely to see rapid transformation include finance, real estate, supply chain, and media. Those in leadership positions should focus on pilot projects, partnerships, and joining industry consortia to gain practical insights.

The question is not whether these technologies will impact business; it is how soon and to what extent they will do so. Early engagement could mean the difference between shaping the market and reacting to it.

Preparing for the Shift from Web2 to Web3

This decade will not just be about refining existing digital strategies; it will be about fundamentally rethinking business models and how they can be adapted for businesses to remain relevant. Web3, blockchain, and tokenisation represent more than just new tools; they embody a shift toward decentralisation, ownership, and transparency.

For UK businesses to lead, rather than follow, they must shed the fear of uncertainty and invest in understanding these technologies now. Executives who are prepared to question their current assumptions, explore pilot projects, and invest in new skills will be the ones who navigate the transition successfully.

Transformation is inevitable, but leadership will determine whether it brings progress or disruption. The choice is not about embracing change; it is about preparing for it with intelligence and strategy.